Moving home | Existing Customers | Accord Mortgage

Moving with your mortgage

Buying a new home with us

Moving your existing mortgage deal to a new home is called 'porting' or 'portability.' Exactly how it works depends on the purchase price of your new home and your current mortgage. You can find out more about your options below.

What's on this page?

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

What will happen to my current mortgage?

What would you like to do?

I’d like to borrow more

New property value - Current property value = New borrowing amount

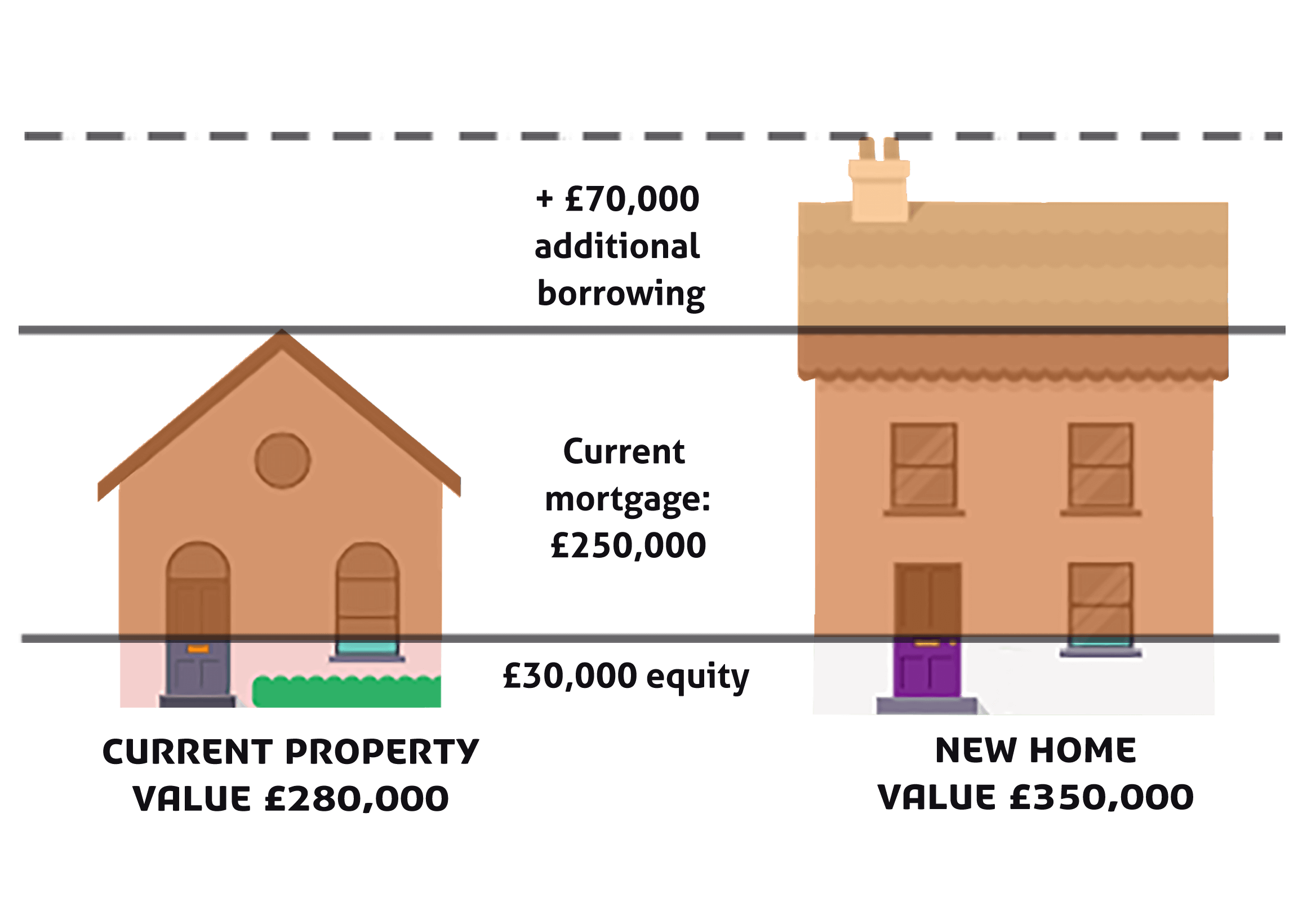

Example:

- David owns a property worth £280,000 and has £250,000 left on his mortgage.

- This means that David has £30,000 equity on his home.

- David would like to buy a new property worth £350,000 so he will need to borrow more.

- To work out how much more David needs to borrow, he takes his current property value (£280,000) from the total value of his new property (£350,000).

- David works out that he needs to borrow £70,000 more.

- David borrows £70,000 using the £30,000 equity built up on his current home as the deposit.

I need to borrow less

New property value - Current equity amount = New borrowing amount

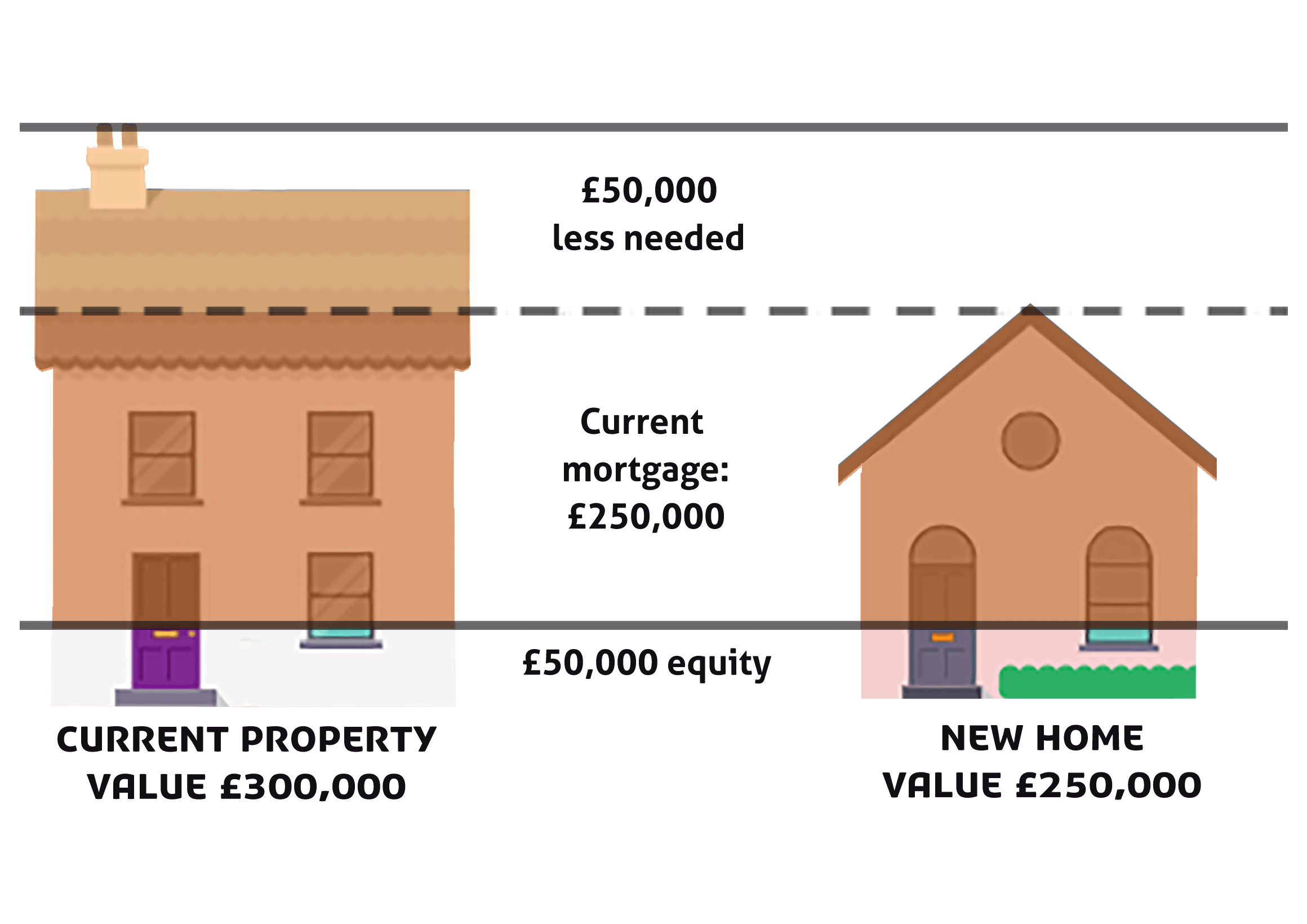

Example:

- Julia owns a property worth £300,000 and has £250,000 left on her mortgage.

- This means that Julia has £50,000 equity in her home.

- Julia would like to buy a new property worth £250,000.

- To work out how much she needs to borrow, Julia takes her current equity amount (£50,000) from her new property value (£250,000).

- Julia works out she needs to borrow £200,000.

- Julia borrows £200,000 using her £50,000 equity as a deposit.

I want to borrow the same amount

Example:

- If Fay has £50,000 left on her current mortgage and her new mortgage is for the same amount.

- Fay can move and we will refund her 100% of any early repayment charges she has paid as long as she stays in the same LTV band.

I need to add or remove someone from my mortgage

Check your most recent mortgage offer

Check you can apply before you contact us

Get in touch

Call us on:

0345 1200 891

9am to 5pm Monday to Friday

9am to 1pm Saturday

Calls to 03 numbers are charged at the same rate as 01 or 02 from all phones.

Things to be aware of

You will need to pay off your existing mortgage as part of moving your current deal to a new property.

If you borrow the same amount or less, your new mortgage deal will have the same terms and interest rate as your existing mortgage.

We will need to do affordability checks for your new mortgage deal.

You'll need to complete on your new mortgage within six months of paying off your existing mortgage to get an early repayment charges refund.

You'll need to pay any relevant or applicable fees (valuation fee etc) as required and the new property should meet our lending criteria and policy.

If your LTV changes then you may need to move part of your mortgage to a new product. This might mean you have to pay some Early Repayment Charges.

What legal advice will I need?

When you port a mortgage, you will need a conveyancer to carry out the legal work for you.

You can use our conveyancing service to find a conveyancer, or you can choose one of your own. If you decide to choose one of your own, they must be on our approved panel.

If you use our conveyancing service, you’ll get a range of quotes from up to 60 firms. The service is completely independent, and you will have your quotes within seconds.