Consumer Buy to Let Information | Accord Mortgages

Consumer Buy to Let

CBTL mortgages are regulated as residential mortgages and are aimed at ‘accidental’ or non-professional landlords

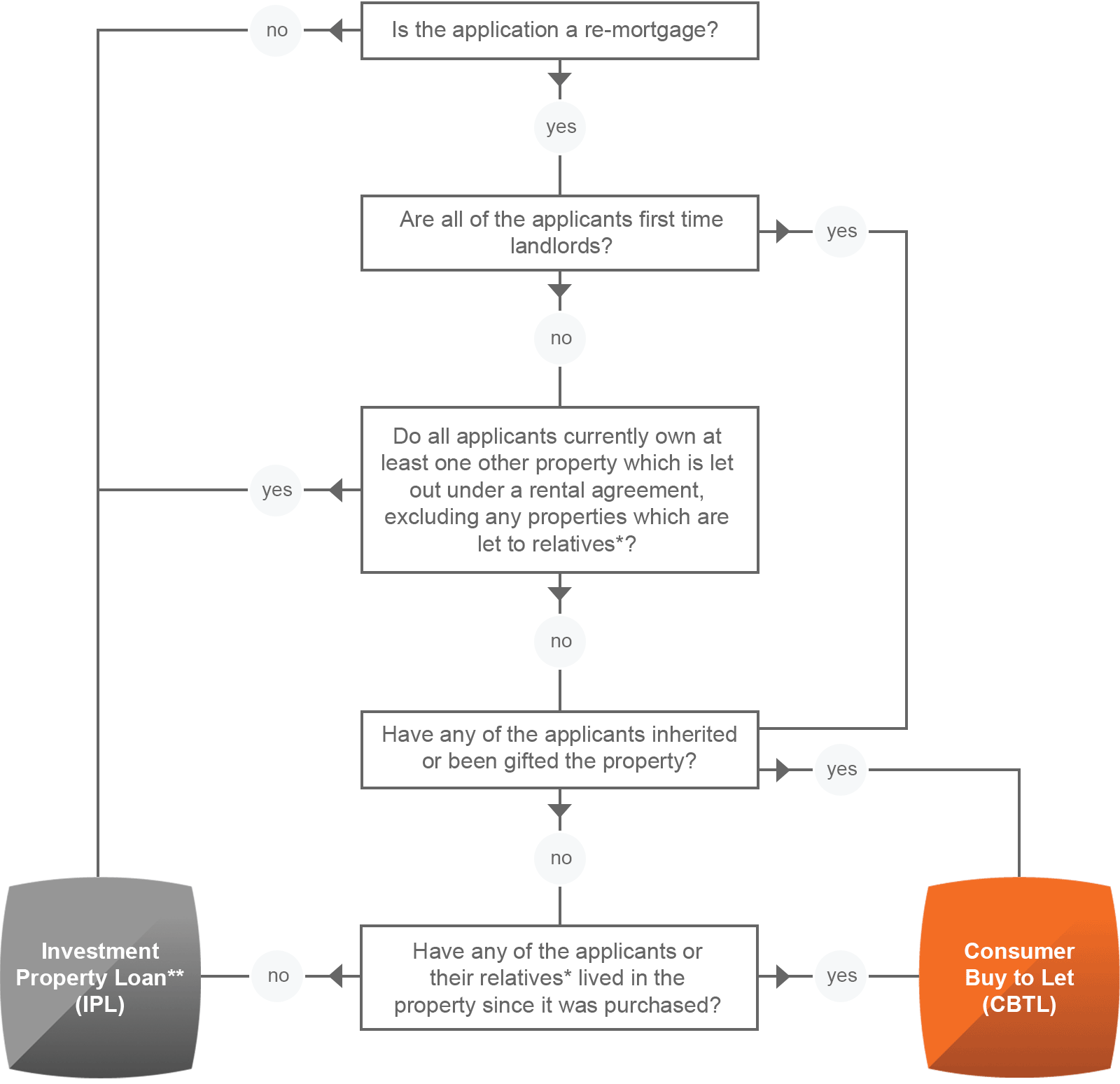

We recently made our entire BTL product range available for Consumer Buy to Let (CBTL) mortgages. Below is a flow chart to help you determine if your clients mortgage is classed a CBTL or Investment Property Loan.

Remember, a firm that advises on, arranges, lends or administers CBTL mortgages must be authorised to do so.

*Relatives are an applicant's spouse or civil partner (or person with the same characteristics of this type of relationship regardless of whether or not of the opposite sex), parent, sister, brother, child, grandparent or grandchild. (This includes scenarios such as stepparents/children.)

**An Investment Property Loan is a non-consumer Buy to let mortgage that will not be occupied by the borrower or their relatives and has been entered into a predominantly for the purpose of the business.

***If an applicant is letting out another property to a non-family member under a consent to let agreement, this would be considered as owning another property let under a rental agreement

Product finder

Rental calculator

Use our rental calculator to work out the minimum rent required for a buy-to-let mortgage.

Rental Calculator